PC sales have been buoyant in recent months and the PC industry is one of the lucky sectors that has actually grown strongly off the back of the Covid-19 pandemic. Early in 2020 it seemed like Covid-19 might hurt PC makers as large swathes of the Far East locked down, closing the factories which supply essential PC components, as well as assemble PCs and laptops. However, the region bounced back strongly after effective containment and elimination of the virus.

In the West demand for PCs and connected devices started to increase as countries locked down and we saw the first evidence of this in HEXUS news with Apple enjoying YoY growth in revenue driven by an "all-time record in Services". In July the idea that PC/laptop/device and component businesses would benefit from lockdowns was cemented by JPR's market insight, predicting a PC Gaming hardware surge, and Microsoft enjoying double digit revenue gains across its software, cloud, devices and gaming segments.

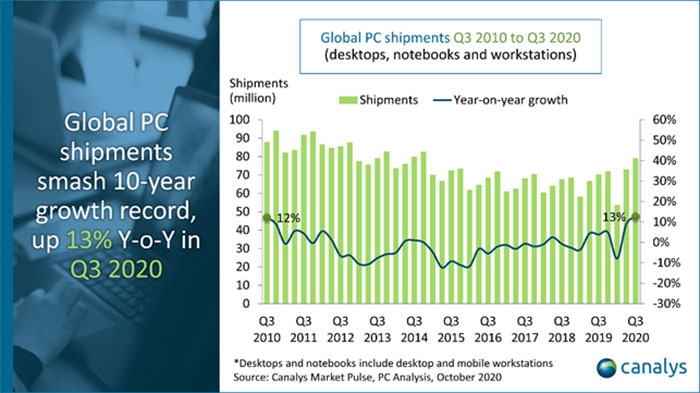

Just ahead of the weekend Canalys shared its latest report on the state of the PC market. The headline data showed that PC sales were up nearly 13 per cent year on year - the highest growth observed in 10 years. There were 79.2 million PCs shipped in Q3 2020, which included 64 million laptops. Further analysis of the desktop/laptop split reveals that laptops sales were up 28.3 per cent with desktop PC sales shrinking by 26.0 per cent.

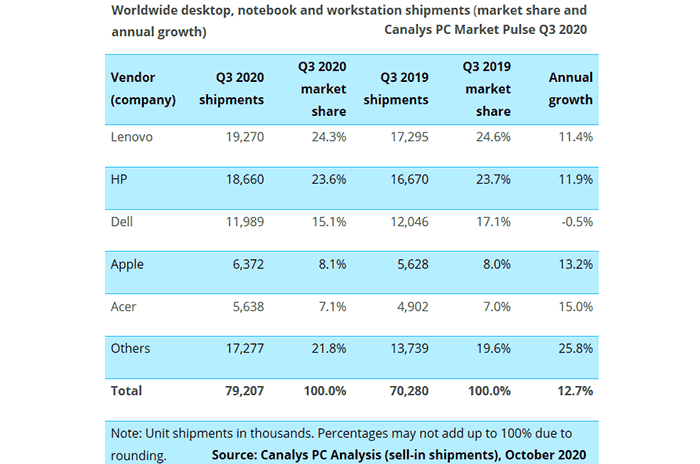

Canalys tracks the sales performance of the big PC systems makers and noted that Lenovo held the top spot in Q3 this year (19.3 million units), closely followed by HP (18.7m). Dell, Apple and Acer completed the top five, with 12.0m, 6.4m, and 5.6m unit sales, respectively.

With work and home PC use increasingly blurred people are looking for good all round performers that are still easily portable and have good battery life. However, there is still a lot of room for differentiating products with a specialist focus on gaming, mobile connectivity, portability, 2-in-1 use etc.