The last time HEXUS reported on DRAM prices was in late October, as part of a news article mainly looking at NAND pricing declines, and the expected continued drop in SSD pricing. At that time the source, Taiwan’s DigiTimes, said it expected DRAM pricing to “stay flat” though it had previously noted Chinese memory makers coming on line could make a big impact in 2019.

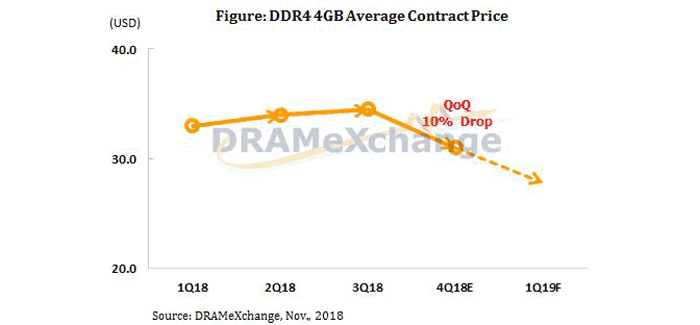

DRAMeXchange QoQ chart with prediction for 1Q19

On Monday DRAMeXchange, a division of TrendForce, noted that it has already seen the average price of 4GB PC DRAM module contracts drop by a significant amount QoQ. In particular it says that “the average price of 4GB PC DRAM modules for 4Q18 contracts has dropped by 10.14% QoQ from US$34.5 in 3Q18 to the current US$31.” 8GB PC DRAM contracts dropped by a similar degree, from US$68 in 3Q18 to the current US$61.

The above could mark the start of an established downtrend. DRAMeXchange adds that “the DRAM market has just entered oversupply,” so that we could very well be looking at continued DRAM price declines during November and December. “DRAM suppliers are now eager to sell off their inventory,” the source reasons. Part of the reason for DRAM oversupply right now is said to be the shortage of Intel CPUs, stifling PC industry demand.

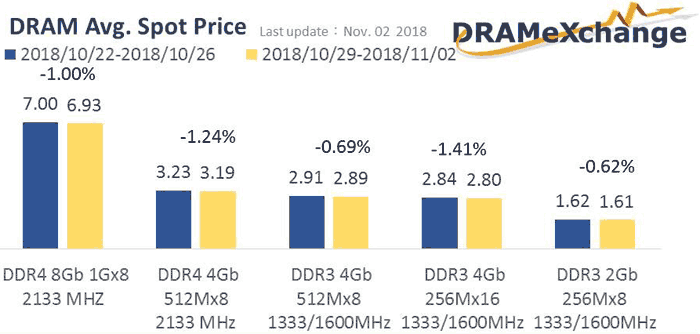

Latest weekly DRAM spot price changes recorded by DRAMeXchange

Another interesting observation by the source is that suppliers are upgrading their lines towards 8GB modules, and that “8GB modules will surpass 4GB counterparts in shipment volume much sooner than originally anticipated and become the market mainstream”. Thus DRAMeXchange plans to make prices of 8GB modules the base for determining the contract price trend in the PC DRAM market, starting in 2019.