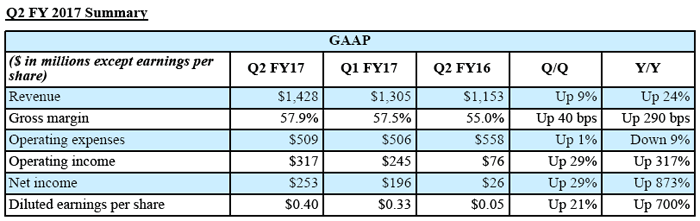

Nvidia has reported a very strong set of financials with its second quarter fiscal 2017 results. The financial highlights are record revenue of $1.43 billion, up 24 per cent year-on-year, and up 9 per cent from the previous quarter. Earnings per share was 40 cents. Those figures were significantly better than expectations. Analysts had expected a revenue figure of $1.35 billion, and earnings per share of 37 cents. Nvidia shares have been up as much as 4 per cent in afterhours trading.

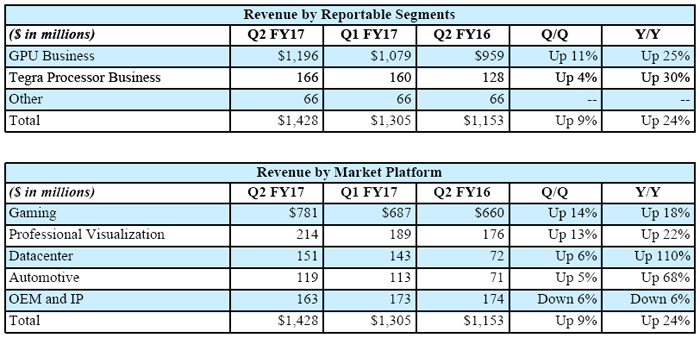

Importantly for Nvidia, the results show that it is experiencing "growth across all platforms". A few years ago it sought to spread its R&D across various IT technologies, de-emphasising PC components, and it looks like most of its bets have worked out. Nevertheless, in the most recent set of results, Pascal GPUs are one of the star performers for the company, alongside the newer focus of deep learning.

"Strong demand for our new Pascal-generation GPUs and surging interest in deep learning drove record results," said Jen-Hsun Huang, co-founder and chief executive officer, NVIDIA. "Our strategy to focus on creating the future where graphics, computer vision and artificial intelligence converge is fuelling growth across our specialized platforms -- Gaming, Pro Visualisation, Datacentre and Automotive."

If you pass by the Nvidia blog you will see the amount of recent articles about deep learning dominate its home page with just a smattering of news about pro graphics, gaming, corporate and automotive. However you can clearly see from the revenue breakdown chart by market platform, above, that gaming and professional visualisation bring in the lion's share of cash, guaranteeing new GPUs will remain a core activity for Nvidia R&D.

Nvidia is in a solid position in the PC desktop discrete graphics market with the latest market share figures showing it owns about 77 per cent of the market.

In the next quarter Nvidia is expecting revenue to rise to $1.68 billion, plus or minus two percent.