Microsoft released its latest set of financial results last night, after the stock markets closed in the US. Overall the results were good, and after-market stock prices have responded accordingly (up about 4 per cent). All three of Microsoft's business segments saw revenue uplifts in the reported quarter. However, the weakest performance was in the consumer facing 'More Personal Computing' which only managed a 2 per cent gain in revenue. Under this category Windows, and cloud services did well, Surface revenue was up a little, but dragging the segment down was the Xbox content and services revenue, as per our headline.

The results for the quarter ending 31s December 2019 are dubbed by Microsoft's accountants 'FY20 Q2', in case you might get confused by any quotes and charts in the report. Overall Microsoft revenue was $36.9bn, an increase of 14 per cent, and its net income rose to $11.6bn, an increase of 38 per cent. Let's have a look through the results, segment by segment.

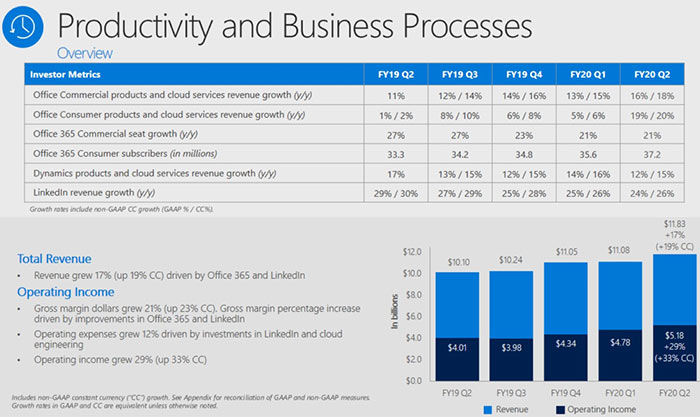

Productivity and Business Processes

This operating segment brought in $11.8bn, up 17 per cent this quarter. Official highlights are provided in the slide below.

This is a very positive set of results for Microsoft in Productivity and Business Processes. Microsoft says chief revenue drivers were Office 365 and LinkedIn, but you can see gains across all the components of this segment.

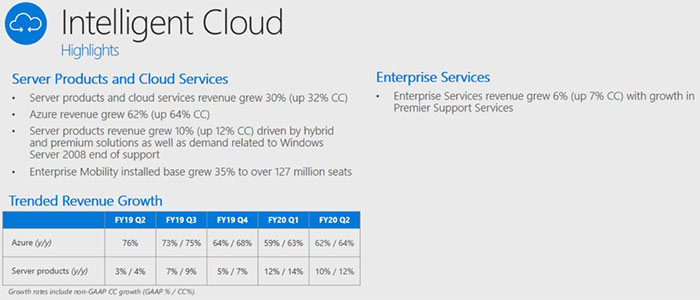

Intelligent Cloud

Intelligent Cloud revenue was up $11.87bn, up 27 per cent, driven by server products and cloud services. Azure revenue was up an impressive 62 per cent.

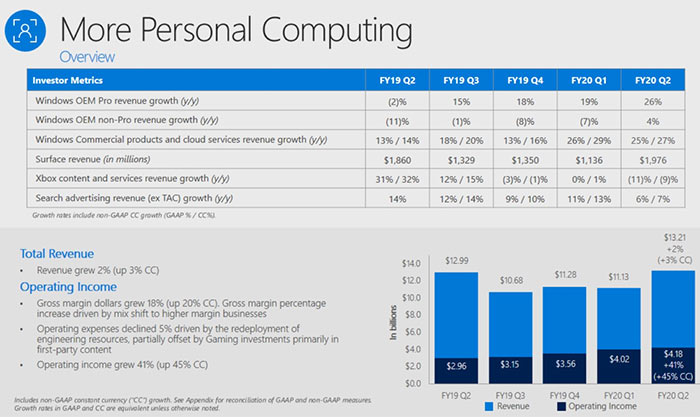

More Personal Computing

Probably the most interesting Microsoft business segment to HEXUS readers, the More Personal Computing segment was positive overall with revenue up by 2 per cent in the quarter. However, the constituent parts of MPC showed highly variable performance.

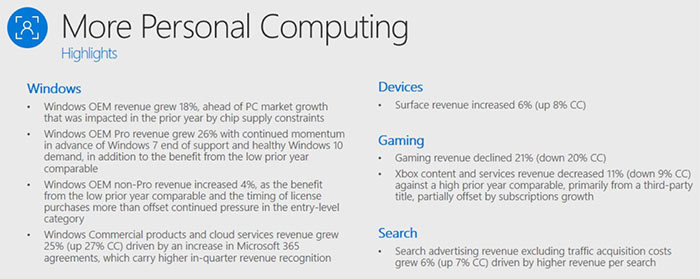

Windows OEM Pro revenue was a bright spot in these results, as was Windows commercial products and cloud service revenue. As you can see above, Xbox content and revenue growth let the side down in a very noticeable way, with revenue down 11 per cent in FY20 Q2. However, this slide was part of a wider gaming revenue decline of 21 per cent, as you can see in the slide below.

Looking ahead in this segment, Surface is expected to continue to grow slowly as Microsoft executes its plan to introduce foldables and other concepts to consumers later in the year. In gaming Microsoft expects low single digit declines to continue for now, until the launch of the Xbox Series X. Talking positively, in a post-results conference call Satya Nadella said that "xCloud is off to a strong start," and that a new record for Xbox Live monthly active users was again set this quarter.