No more Acers up its sleeve

While its marketing people won't thank us for saying so, Acer's main competitive advantage is efficiency. For its size it has a tiny headcount and every stage of making a PC and getting it to market is as streamlined as possible, including its channel-only model. This is especially advantageous on the more commoditised lower-end of the market, where price rules.

And it's the low-end notebook and netbook markets that Acer has mainly to thank for the its climb up the PC OEM rankings in recent years, culminating in its stated ambition of taking top spot from HP before long. So imagine Acer's surprise when it started to lose market share to its polar opposite OEM: Apple.

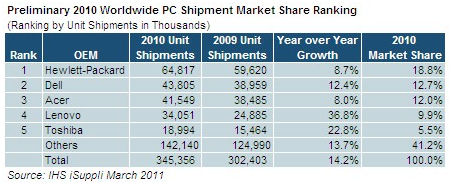

That's the conclusion of market researcher iSuppli, which has blamed the growing tablet market for the decline in sales of notebooks and netbooks. This is the main reason it give for Dell cementing its place back at number two in the PC market, having previously relinquished it to Acer. Dell and HP are less heavily reliant on the consumer market than Acer.

"A little more than one year after a prolonged decline in shipments caused Dell to lose its customary second-place ranking to rival Acer, Dell now seems to have regained a firm hold on the No. 2 rank," said Matthew Wilkins, analyst at IHS, which acquired iSuppli for $95 million late last year.

"Acer in the third quarter of 2009 had surged to the No. 2 spot on the strength of its strong sales of netbook PCs to consumers and a generally buoyant consumer market. However, with momentum for consumer PCs waning and in light of growing competition from media tablets, Acer's gains have been reversed."

Here are the tables. While PC sales slowed down towards the end of last year, Q4 still marked a record quarter, the previous one having been Q4 2009. Furthermore, growth is a lot more balanced now, with more of it coming from the desktop and corporate markets. Hence Acer's issues.