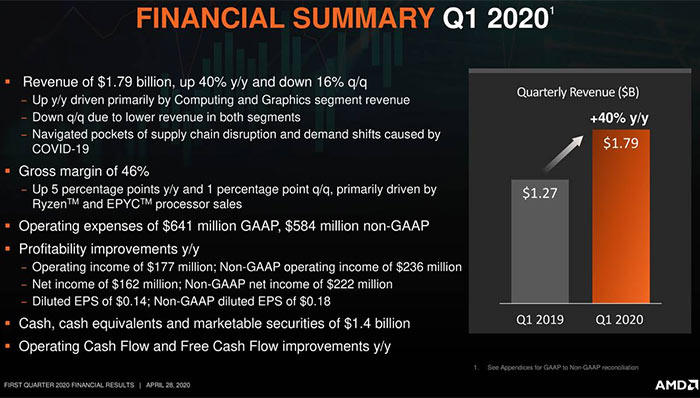

AMD released its latest set of financials yesterday evening after the markets closed in the US. Its headline Q1 2020 financial achievements looked great, with revenue up 40 per cent year-on-year, and a gross margin of 46 per cent. Investors weren't that pleased though, and the share price fell in afterhours trading. Barron's reckons the share price drop was due to the results being in line with expectations but AMD trimming its full year outlook. Pepping up the dry financial release were some interesting morsels of info from AMD, including the assertions that it is "on track to launch next-gen Zen-3 CPUs and RDNA 2 GPUs in late 2020".

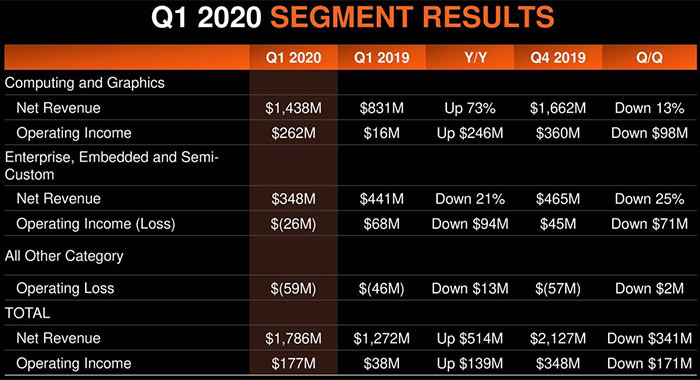

Above you can see AMD's financial summary slide for the most recent quarter. Instrumental to the significant revenue gains was the success of the Computing and Graphics Segment. In further analysis AMD provided figures showing Ryzen and Radeon sales were up 73 per cent YoY. However, the most recent quarter sales were down 13 per cent sequentially mainly due to the GPU side of things. Average Selling Prices (ASPs) were driven up by new Ryzen processors but impacted negatively by increased laptop sales. AMD makes less on laptop processors (selling to those big corporate customers) but is happy to take revenue from them, and says it has over 135 laptop design wins which will be released over the coming months.

As mentioned in the intro, Gross Margin (GM) was 46 per cent, a figure up five per cent YoY and up one per cent QoQ. The GM uplift was largely thanks to Ryzen and Epyc CPU sales.

Having just mentioned Epyc, let's have a look at AMD's Enterprise, Embedded and Semi-Custom segment. Overall the picture wasn't rosy with revenue down 21 per cent YoY (and 25 per cent QoQ), primarily due to reduced semi-custom sales. We know this is basically a period of respite as the games console industry changes gears - older console sales are stagnating somewhat but it won't be long until AMD is bolstered by demand for components for the upcoming PS5 / Xbox Series X generation. AMD Epyc sales were a positive though and partially offset the semi-custom slow down.

AMD shared some strategic news with regard to its HPC kit. Server shipments with AMD processors grew by double digits in the most recent quarter. The chip designer was rather proud that its Epyc CPUs and Radeon Instinct GPUs will power the 2 Exaflops+ El Capitan Supercomputer. Furthermore, Microsoft Azure, Google, and IBM all announced new 2nd Gen AMD Epyc processor offerings.

Last but not least, AMD asserts alongside the latest results, that it is "on track to launch next-gen Zen-3 CPUs and RDNA 2 GPUs in late 2020". This will come despite the "challenging environment" and continued uncertainty due to the Covid-19 pandemic. Remember that AMD shares have been effectively marked down due to its cautious statement for the rest of the year. For example, AMD warned that its longer term prospects could be impacted if consumer demand for the Microsoft Xbox Series X and Sony PlayStation 5 was stifled due to the global economic backdrop.