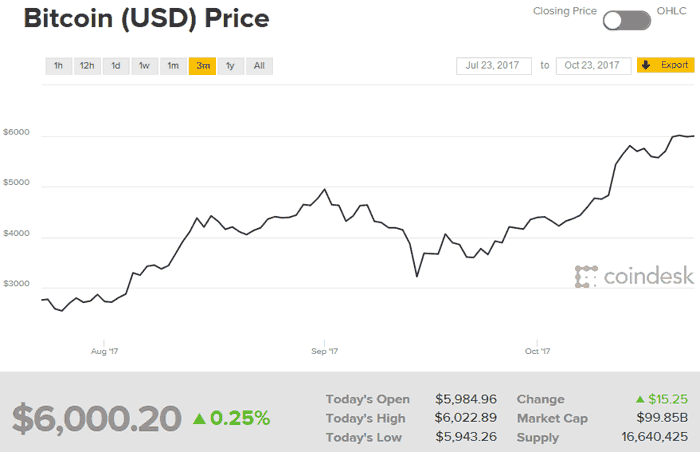

A couple of months back, on Monday 14th August to be exact, one of the most interesting news pieces kicking off the week was Bitcoin’s surge past $4,000 in value. The first comments on that story proclaimed Bitcoin was a bubble about to burst. However, if one had invested in Bitcoin at that time, just a few weeks ago, today you would be able to sell-up for a 50 per cent gain – a very tidy profit when banks offer a fraction of a per cent a year in savings accounts. Yes, Bitcoin’s value breached $6,000 this weekend, hitting a record high of $6,147.07 (£4,660) just a day after pushing through the $6,000 mark.

CNBC provides some background to this impressive rise in value. There are a couple of big reasons for Bitcoin’s recent ascent to new highs. First of all there is an upcoming fork (13th Nov) in the cryptocurrency which will result in the creation of a new currency called Bitcoin Gold. Holders of Bitcoin “will get some Bitcoin Gold when it is issued, essentially giving them free money,” says CNBC. Secondly there is talk of China reversing its ban on cryptocurrency exchanges, a move which could provide a big boost to Bitcoin.

In a recent CNBC survey, the majority of 23,000 respondents tipped Bitcoin as heading to over $10,000. The timescale for this ascent could be as little as the next six months reckons one former ‘legendary’ hedge fund manager. It sounds like there could be lots of volatility leading up to 13th Nov and after that there might be some kind of sell-off – similar to when shares get a dividend paid to holders on a certain date. Please don’t buy or sell Bitcoin based on the news presented here, only do so after your own thorough research and using cash reserves you can afford to depreciate.