Intel published its Q3 2020 financials yesterday evening after the markets closed stateside. The results were broadly in line with what analysts had expected. Nevertheless, we have seen a significant pull-back in the share price in afterhours trading as investors seemed to be spooked by the Data Centre Group's weak performance.

Those watching the ups and downs of the business landscape since Covid-19 became a thing will broadly expect IT businesses to be faring well. After an initial production speed bump in the Far East due to the pandemic, western lockdowns inspired sales of lots of WFH kit, and all sorts of connected tech and services.

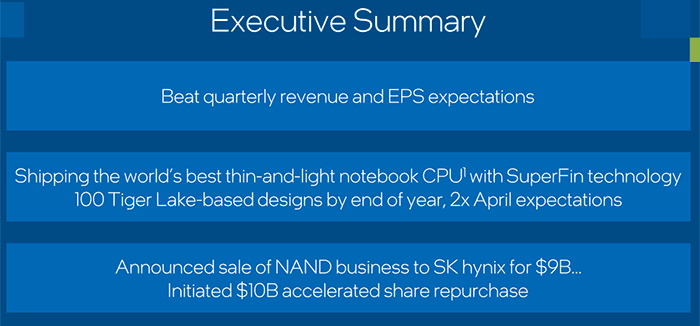

Intel CEO Bob Swan described the latest financial results as "solid," and said they were better than Intel's internal expectations, with it feeling "pandemic-related impacts in significant portions of the business".

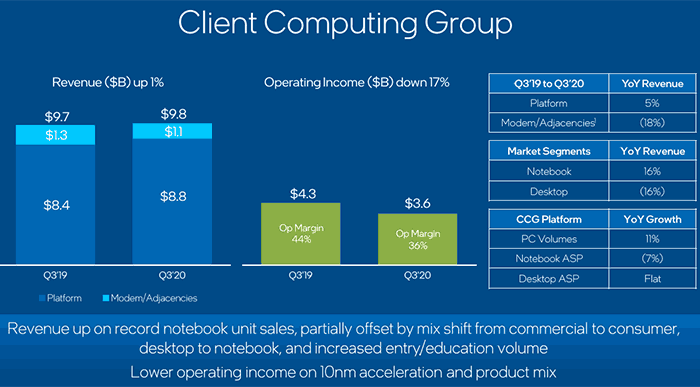

Intel's Client Computing Group, the one that is responsible for the PC CPUs that are always reviewed by HEXUS on release day, actually grew. Its revenues in Q3 were up one per cent YoY. It brought in $9.85 billion in revenue, which was better than the $9.09 billion expected among analysts. As mentioned in my note about the pandemic, PC and laptop sales are very buoyant right now. Gartner estimates that PC shipments grew 3.6 per cent in Q3, for example.

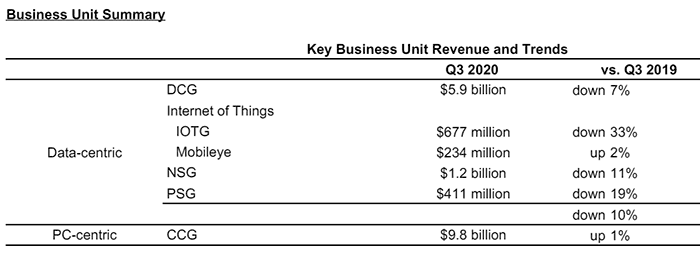

Intel's data centric businesses are all experiencing tough times it seems. The Data Centre Group's revenue from cloud service providers, enterprise, governments and so on was down 7 per cent at $5.9bn while analysts had expected a figure of about $6.2bn. Its smaller operations such as the IOTG, Mobileye (Automotive), NSG (memory and storage business), and PSG (programmable semiconductors) were all down too. Check out the chart below for specifics.

Looking forward to FY 2020 Intel expects and overall uplift in PC-centric and Data-centric revenues in "mid-single digits" percentages. It boasts of over 150 Tiger Lake designs coming to market soon from its partners. 100 designs will arrive before 2020 is out, and 40 of the designs will be Intel Evo certified. All these new designs will feature processors manufactured using Intel's 10nm SuperFin process technology. On a related note Intel says its third 10nm manufacturing facility, which is located in Arizona, is now fully operational "and the company now expects to ship 30 per cent higher 10nm product volumes in 2020 compared to January expectations".

In the wake of the above financial release from Intel its shares have slid 10 per cent, meanwhile rival AMD is up 2 per cent.