Pyrrhic victories

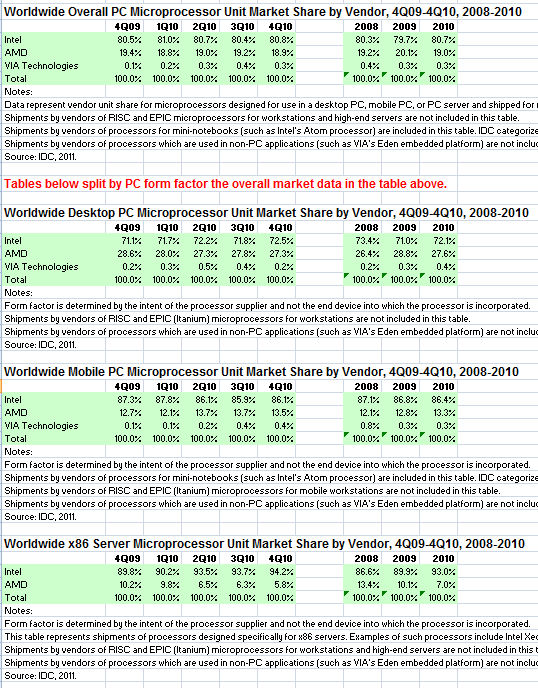

The latest global CPU market figures from IDC reveal a marked slow-down towards the end of last year. Shipment growth was slightly negative, both sequentially and year-on-year, in a quarter that usually sees a spike.

With the start of this year dominated by the arrival of Android tablets, it would be easy to say the PC market is in terminal decline, but within the weak Q4 figures are some encouraging details.

The shift towards mobile CPUs continues, accounting for 54.1 percent of shipments in 2010, compared to 50.2 percent the year before. But the segment most heavily hit by mobile devices is the low-end, with Atom-powered netbooks in rapid decline.

An indirect benefit of this, however, has been to create a clearer distinction between a notebook and a mobile device in the minds of end-users. This has resulted in increased sales of more expensive, higher specced notebooks and, as a consequence, an increase in the average selling price of CPUs.

"The fourth quarter was weak and out of synch with normal seasonal patterns in terms of unit shipments," said Shane Rau, director at IDC. "The first half of the year turned out to be the better half of the year.

"However, looking back at the whole year 2010, it's clear that the ongoing shift to mobile processors, combined with a shift back towards high-performance mobile processors, as opposed to Atom processors for netbooks, drove a significant rise in overall processor average selling prices." ASPs rose by eight percent, returning to pre-Atom levels.

Among the vendors, this is good news for AMD, which has made notebook chips its primary focus through its Vision strategy. This has come at a cost, however. As you can see in the screenshot of IDC's figures below, AMD has lost a bit of share in desktops and a lot in servers over the past year, in return for a percentage point of mobile market share.