Stagflation 2

We're not for a second claiming we could do any better, but the governor of the Bank of England appears to have made a pretty stark admission of defeat today.

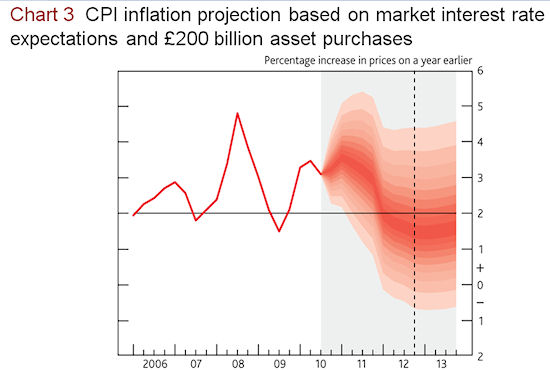

In his Inflation Report press conference Mervyn King said: "Despite weak demand, inflation remains more than a percentage point above our 2 percent target." He then went on to blame this state of affairs on a bunch of stuff outside his control, such as exchange rates, commodity prices and VAT increases.

He then admitted: "... it is hard to judge how inflation will evolve in the medium term," but he conceded: "Inflation is likely to remain above the 2 percent target throughout 2011," and that "Unemployment, at almost 8 percent, is high."

Back in the middle of the last century, economic consensus was that it's impossible to have both high inflation and high unemployment - otherwise known as stagflation - because of the deflationary effects of the latter. That was disproved in the 70s, and looks set to be once more.

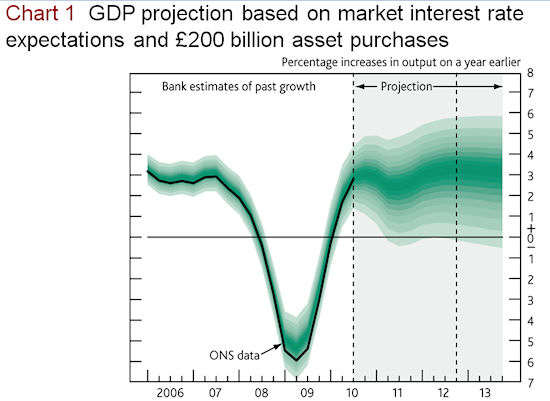

Given that the Bank of England Monetary Committee's primary stated aim is to keep inflation as close to two percent as possible, and that by its own projections (see below) inflation is set to top three percent for at least two years, this would seem to be as close to an admission of failure as we're likely to get.

We do have some sympathy with the Committee, however. Were it operating on a purely financial environment it would probably have already risen interest rates, which most likely would have lowered inflation. But despite the B of E being supposedly independent, it's clearly under political pressure not to do anything to pour water on our weak economic recovery.

So we're probably going to see no interest rises for a while yet, and might even have a spot of QE2, which will keep inflation high. At the same time the government will continue to trim the considerable fat off the public sector, most probably leading to higher unemployment. The fact that much of this is beyond the Committee's control makes us wonder what the point of it is at all.