Microsoft published its 2015 Q4 financial results last night. The quarterly results are some of the worst ever for the company overall with a loss of $2.1 billion recorded. For what is normally a profitable company it was unusual to see such a loss, but if not for some extraordinary one-off write down and restructuring charges it did better than analysts had expected.

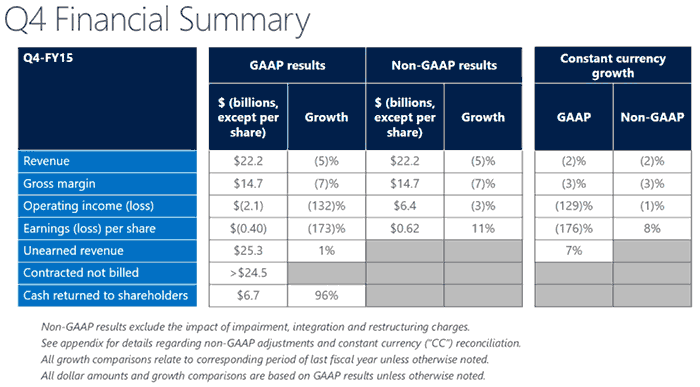

During Q4 2015 Microsoft's revenue was $22.2 billion. As mentioned above, the loss recorded by its accountants was $2.1 billion. The huge charges that resulted in that recorded loss include; a $7.5 billion non-cash impairment charge due to the acquisition of the Nokia Devices and Services, a restructuring charge of $780 million, and a charge of $160 million related to the ongoing integration and restructuring plan. Those add up to $8.4 billion of negative impact. Microsoft says that if this impact were excluded it would have been able to publish profits of $6.4 billion. It is also notable that Microsoft returned $6.7 billion to shareholders in the form of share repurchases and dividends during the three months ending 30th June 2015. The strong dollar did Microsoft no favours with a negative impact of $753 million during the quarter.

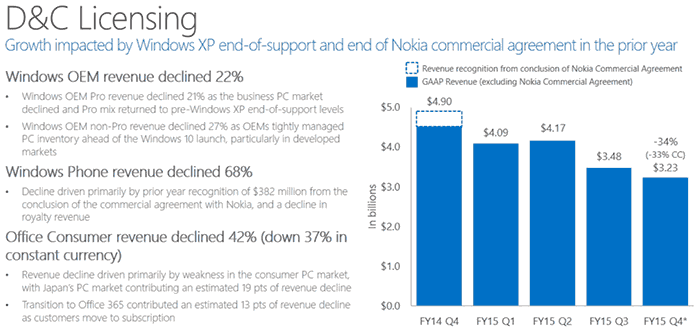

Looking at Microsoft's Devices and Consumer business first, it was noted in the results that Windows OEM revenue decreased by 22 per cent to $8.7 billion. That could be expected in the quarter leading up to a major new OS release. Windows Phone revenue was also down by 68 per cent but this was largely due to a prior year recognition of $382 million in the Nokia agreement. However the Devices and Consumer business was full of otherwise positive results including:

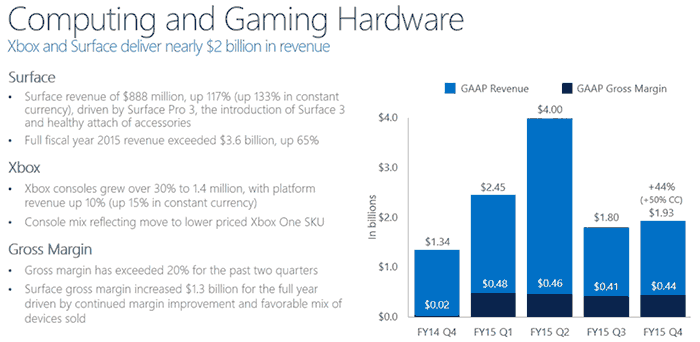

- Surface revenue grew 117% to $888 million, driven by Surface Pro 3 and launch of the Surface 3

- Total Xbox revenue grew 27% based on strong growth in consoles, Xbox Live transactions and first party games

- Search advertising revenue grew 21% with Bing U.S. market share at 20.3%, up 110 basis points over the prior year

- Office 365 Consumer subscribers increased to 15.2 million, with nearly 3 million subscribers added in the quarter. But traditional Office software consumer revenue went down by 42%.

Microsoft's Commercial business revenue grew by three per cent to $13.5 billion. Commercial Cloud revenue was a star performer, up 88 per cent thanks mainly to Office 365, Azure and Dynamics CRM Online. Further single digit revenue growth was seen by Server products and services and Dynamics. Meanwhile Office Commercial products and services revenue declined four per cent and Windows volume licensing revenue declined eight per cent.

In the coming quarter Microsoft will, for the first time, be providing free OS upgrades to a large number of its current OS users. The WSJ says that it expects to make up revenue 'lost' in the giveaway by selling add-ons like PC videogames, Office and Web-search ads. It remains to be seen how successful this revenue stream switch can be.

Microsoft shares are currently down by 3.75 per cent in pre-market trading.