Intel released its latest quarterly earnings report at the end of trading yesterday in the USA. The key messages CEO Brian Krzanich wants to pass on are that Intel enjoyed “strong results across the business,” and that the corporation is “on track to a record year”.

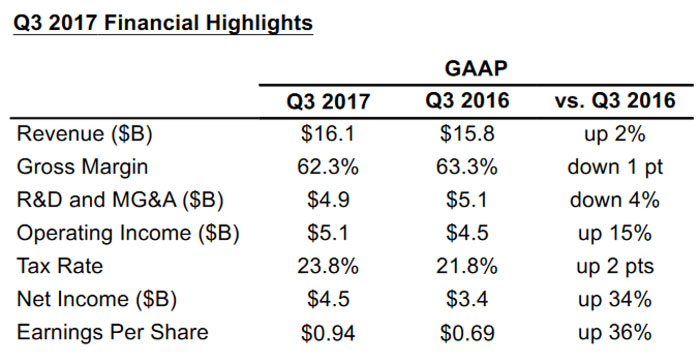

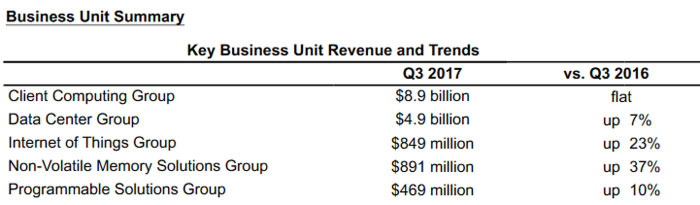

Headlining financial data is summarised in the chart above. As you can see, Intel generated $16.1 billion in revenue during Q3 2017. From that it managed to hold onto $5.1 as profits. Examining the separate parts of the business, every segment except for Client Computing Group (the bit we are most interested in at HEXUS – the PC business) enjoyed good growth, particularly the Internet of Things Group and Non-Volatile Memory Solutions Group.

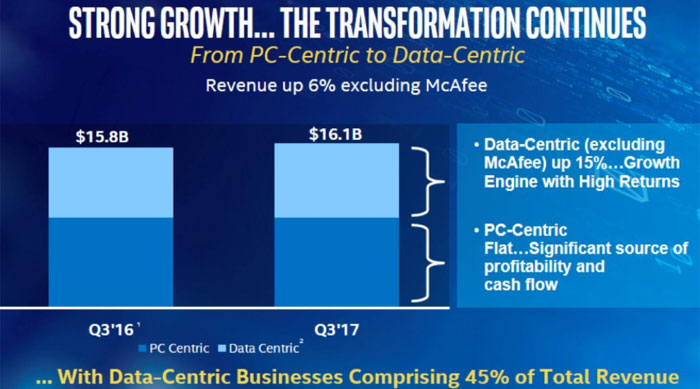

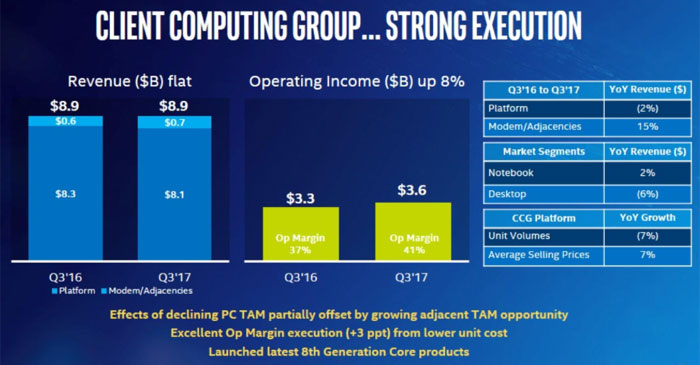

Though the Client Computing Group revenue trended flat, it is still a bigger business than all the other segments put together and Intel should do more to strengthen its prospects. Intel still aims to transform “from PC-centric to Data-centric,” as you can see from the ‘flavour’ of the slide below.

Though revenue was flat for Client Computing, Intel still managed to squeeze more out of PC enthusiasts as can be seen by the rise of operating margin from 37 to 41 per cent.

Key events of the most recent quarter include the rollout of Xeon Scalable, 8th Gen Core processors, and 64-layer SSD for data centres. Intel also completed a key investment in Mobileye, announced a design win with Waymo, made important AI advances with Loihi and Nervana, and has signed long-term NAND supply agreements worth more than $2 billion.