Cheaper shiny things

The European Commission issued a statement today approving of the action the new government took in the 22 June emergency budget to reduce our vertiginous national debt. This coincides with an overall strengthening of the pound since its trough just after the general election.

"The current economic circumstances call for a decisive fiscal consolidation, while not suffocating the nascent economic recovery. The budgetary targets presented by the UK Government are in line with this strategy," said economic and monetary affairs commissioner Olli Rehn.

Prior to the 8 May general election there had been a real danger that the UK would have its debt downgraded due to concerns about its ability to service borrowing of the kind not seen since the Second World War. This could have precipitated a spiral in which new debt would have become more expensive and thus made it harder to pay off.

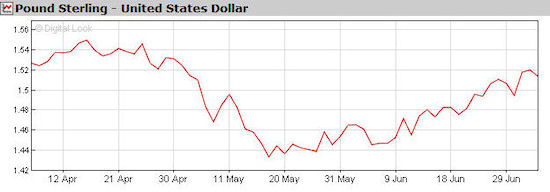

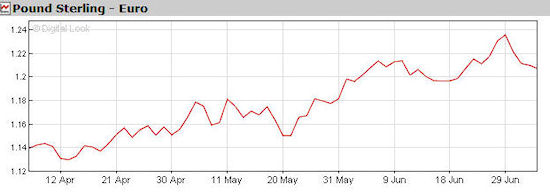

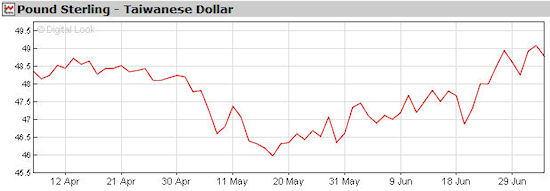

Currency speculators seem to have reacted approvingly of these measures too, as sterling has gained ground against not just the dollar and the euro, but Far-Eastern currencies too, as show in the screen grabs from the BBC website below.

A weak pound is good for exporters as it make our products more price-competitive. But the the UK tech channel, which imports most of its products, will benefit from a stronger pound as it makes those imports cheaper.