There are concerns that the tech industry will have to brace for further component price rises shortly. Of course, higher component costs are going to be inevitably passed onto consumers. This news comes from several Taiwanese business news publications citing sources at, or in business dealings with, the world's biggest contract foundry - TSMC. Depending on the product/process, TSMC's customer can expect to pay up to 20 per cent more for their chips.

A wide range of influences have come together to inspire the price rises. What you might call and 'imperfect storm' of factors have lead TSMC to its price rise decision. There are so many factors listed by the sources that I've decided to bullet point them:

- TSMC's gross margin has fallen under the industry standard 50 per cent

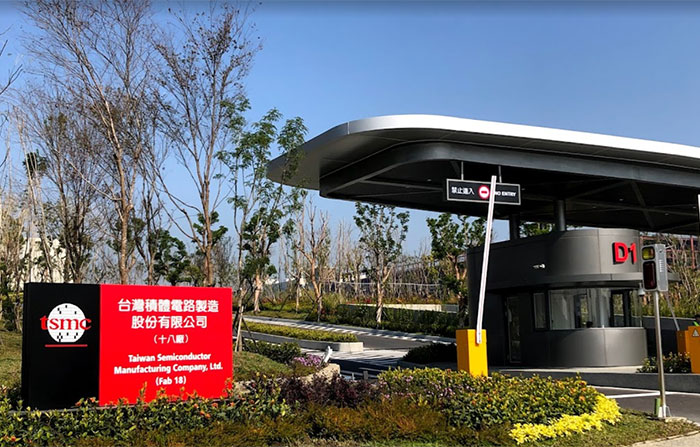

- TSMC has started several large and costly expansion initiatives (large new factories abroad, and advanced facilities in Taiwan) and has to service investor return

- Demand is up and shortages are intensifying

- Raw materials prices have increased

- Freight rates have increased

- Other inflationary and geopolitical pressures at play

The various sources have slightly different stories about the impending TSMC foundry price hikes. Mostly the reports are quite similar, and seem to point to the TSMC price increases being applied to contract work from Q1 2022 onwards.

Another area where the reports seem to agree is that the price rises will apply differently across different processes. Specifically, customers of advanced processes (sub 12nm) will be facing price increases of up to 10 per cent. Meanwhile, customers reliant on the more mature processes (16nm+) will be looking at 10 to 20 per cent price increases.

At this time, in the strange constrained market we are in, it is hard to know what impacts there will be on consumer products reliant on TSMC's process technology. Remember that the semiconductor industry seems to be rather cyclical, and as a consumer one must hope that whatever machinations are happening in the background now, there will be oversupply in the not-too-distant future and prices will respond. Most news and tech industry comments I have read recently indicate that semiconductor component supply problems will ease next year – which leads one to wonder about the scale and speed of the easing we will see.

Sources: Financial Analyst Dan Nystedt, UDN, Commercial Times.