Press release

DRAMeXchange expects some players with weak cost structures that may follow the production cutback trend, thus, DRAM output is estimated to be reduced by 6-8 % in total.At present, the DRAM industry is not about winning or losing of companies unless the DRAM output is adjusted. Instead, it will be a loss encompassing everyone, says DRAMeXchange.

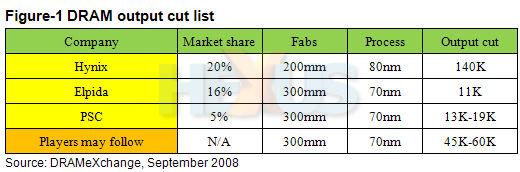

After Elpida/PSC's 10-15% output cut, Hynix Semiconductor Inc. (Hynix) announced operation stoppage of total production output will come from 200mm FABs. Amid the reduction of Elpida/PSC, together with Hynix, global DRAM output is estimated to be reduced by 5-6 %., according to DRAMeXchange. According to DRAMeXchange's analysts, Hynix's announcement for output cut is a difficult yet a very wise decision. As a leader in DRAM, its output cut will have a positive outlook on the industry.

DRAM spot price has dropped by an approximate of 20% since the end of the Beijing Olympics. The present pricing is still lower than makers' variable cost of US$1.30-1.50.

To ensure an earlier recovery, some second-tier suppliers are suggested to cut output to ensure stability in market. DRAMeXchange expects some players with weak cost structures that may follow the production cutback trend, thus, DRAM output is estimated to be reduced by 6-8 % in total. Some second-tier DRAM makers with weak cost structures are also recommended to scale back production in helping the industry to weather the worst slowdown in history.

The current DRAM market slowdown, which has already lasted for two years, has caused the cash levels of DRAM makers to drop substantially. Businesses have been difficult to run, and investors and banks are not pleased. Progress in the investments of more advanced technology has come to a halt, as well. This will undoubtedly impact the entire industry and consumers. Analysts have indicated that coupled with the current macroeconomic woes, substantial changes in the PC/NB market has been seen. DRAM makers can no longer rely on the bit growth in projecting their output. Instead, they must focus on the sales revenue and return on assets as their primary targets.

At present, the DRAM industry is not about winning or losing of companies unless the DRAM output is adjusted. Instead, it will be a loss encompassing everyone, says DRAMeXchange.