Asset smart

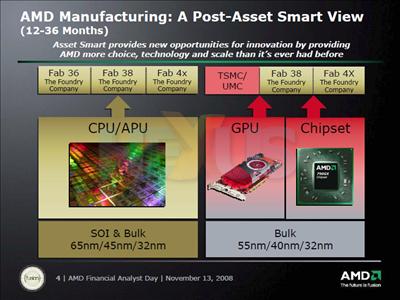

One of the key efficiency measures being taken by AMD is the ‘asset smart' strategy, which essentially amounts to freeing up some of the cash required to build, run and upgrade processor fabrication plants, or ‘fabs' for short, by selling a majority stake to investors.

This not only gave AMD an initial, much needed, cash injection but also provided the new fab operation - provisionally called The Foundry Company - the resources to compete against specialist outsourced fabs like TSMC and UMC. It also freed AMD up to focus on what it does best - design - or so the theory goes.

A return to profitability and the presumed increase in the value of the company that would follow is the primary aim of new CEO Dirk Meyer. AMD remains convinced that the key to doing so is fulfilling the unique potential anticipated by the ATI acquisition, which at the time was encapsulated by the term "Fusion".

Our initial understanding of the significance of Fusion was the combining of CPU and GPU onto one piece of silicon, something only AMD was now uniquely in a position to do. Earlier this year AMD CTO Phil Hester, who left the company not long after, described his vision of an APU (Accelerated Processing Unit), which would be comprised of a number of different, specialised individual processor types - or accelerators.

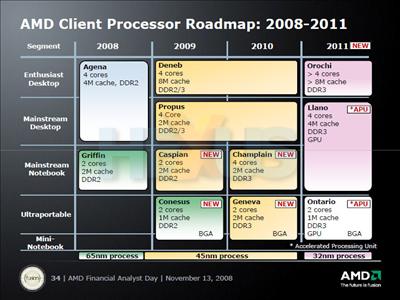

As you can see from this chart of AMD's CPU roadmap, the APU is now finally slated to make an appearance in 2011 - five years after the acquisition.