At what cost?

Culturally AMD was not only automatically moving into new markets, but hoping to create some too. It was also taking on a lot of new people, whose approach to business was in many ways different from its own.

Finally it was also taking on a hell of a lot of debt. The total cost of the ATI acquisition was $5.4 billion dollars. Unfortunately AMD has had to write down around half the value of the acquisition in the two subsequent years, which is one of the reasons it hasn't posted a profit in that time.

AMD's market capitalisation at time of writing was $1.1 billion on a share price of $1.80. Its share price (and thus market cap) was at least ten times greater around the time the ATI acquisition was announced.

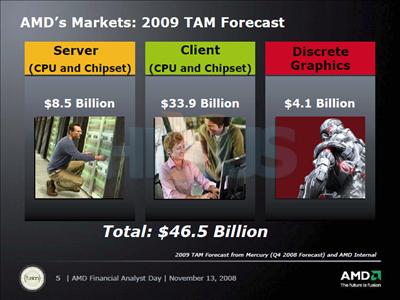

Further ammunition for those who question at least the price if not the overall wisdom of the ATI purchase is provided by this estimate of AMD total available market (TAM) in 2009, by AMD CEO Dirk Meyer at its recent analyst day. As you can see, discrete graphics comprise less than a tenth of the TAM.