A bit of good fortune?

Right now this looks like a pretty good strategy, but there is a strong argument that inspiration has had a helping hand from a decent amount of good fortune in bringing it about.

Firstly, it could be argued that AMD had no choice. It hasn’t been able to produce a monolithic GPU to compete for performance leadership for years and, with NVIDIA’s R&D spend far exceeding its own, it isn’t likely to. So the sensible move is to only fight the fights it can win and that means the mid and lower end markets.

If you can’t crow about overall performance leadership, it makes sense to focus on value and that’s precisely what AMD has done with its stated aim of offering superior performance at every price level. However, under normal circumstances that sensible approach would, to some extent, be trumped by the ‘halo effect’ and greater sexiness that NVIDIA gets from having the overall performance leader.

But these are not normal circumstances. The confluence of the US sub-prime crisis, high commodity prices and a general macroeconomic downturn, in the West at least, means that markets are likely to be more value conscious than they would be during an upturn. This works to AMD’s advantage.

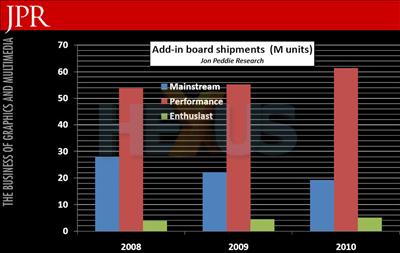

By spending less time and resource obsessing about the top end of the market, AMD is now able to concentrate on what appears to be the most lucrative segment, as illustrated by this chart they showed from graphics market tracker Jon Peddie research.

But the message wasn’t all about value. AMD insists it is now the technology leader over NVIDIA, as illustrated in this slide.