Total Computing

ARM is the dominant company producing intellectual property for mobile-centric devices. This means the Softbank-owned business produces the architecture behind a large chunk of hardware powering mobile, wearables, healthcare, automotive and the nascent Internet of Things (IoT). The scale is breathtaking, with ARM shipping close to 15 billion chips across these various segments last year alone.

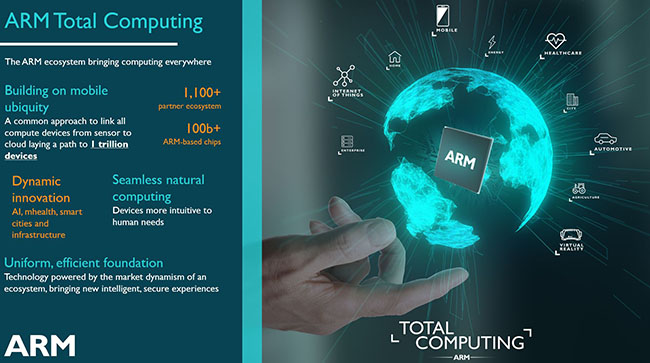

ARM realises that commonality between its architectures and the rise IoT means that, moving forward, a common, company-wide philosophy is needed to tie them all together, harnessing its expertise in mobile and proliferating years of know-how into other, related, younger industries such as automotive and healthcare. This overarching philosophy is called Total Computing.

Over 100bn chips have been shipped to date, with over 1,000 partners in the ecosystem. ARM, through Total Computing, is laying down the ideals and strategy which will enable up to 1 trillion devices by 2035, or 10x all of the chips shipped so far, and is using its unmitigated success in mobile as the blueprint.

ARM's one-trillion device vision, envisioning all the hardware required to support sensors to cloud - IoT in its fullest form - is therefore being built on replicating and enhancing its experiences in mobile. Using the principles gained in producing successive generations of mobile chips, specifically the skills in gained in building secure, highly-efficient chips that excel in low-power operation, ARM believes it can use these fundamental tenets and produce appropriate architectures for other segments such as automotive and healthcare. The strategy that works in the mobile world should, if designed and implemented properly, it believes, work just as well elsewhere.

Total Computing, therefore, is a logical extension to mobile computing, where the ARM architecture enjoys a 95 per cent-plus market share. Each new market will require specific, additional technology to work best. For example, in the automotive space, chips with better safety features and real-time computing will be needed to facilitate the vision of self-driving cars; IoT-specific chips, simpler in design, will need even lower-power operation, while the needs of, say, virtual reality will be met through enhancing the graphics capabilities already present in the latest smartphones. In other words, related but connected products.

Put it another way, Total Computing, in ARM's eyes, will take the system-level approach that has worked so well in mobile and streamline it for other markets and segments. Chip designers for those markets will be free to choose between the best mix of ARM-designed CPU, GPU, DSP, wireless technology, video-processing block, ISP, and interconnects for their business needs.

In its broadest form, ARM sees the IoT ecosystem, which encompasses all the devices connected to the Internet and therefore the one area where there really is opportunity in the billions of units, as being formed by a combination of its core IP technologies, with the exact ratio dependent on the particular segment or product. Total Computing, in a nutshell, is about providing a wide-enough range of IP, based on the mobile environment's three pillars of high performance, low power and security, that can be used in several other markets.

If everything goes to plan, ARM will be thought of less as a mobile-centric producer of processor designs and more as an IP solutions provider for segments and industries that can benefit from machine intelligence.