ARM in Enterprise

ARM Technology is the go-to company for producing the processor architectures that power the vast majority of devices requiring small chips. Often associated with the brains behind smartphones, tablet computers, embedded systems, set-top boxes and in-car entertainment, ARM is taking its small-chip design and thinking big, really big.

The British company believes it has a winning formula for powering the chips contained within massive datacentres that provide the backbone to the internet. This market, loosely dubbed enterprise, is hugely lucrative and, currently, dominated by Intel and its Xeon class of processors. With running costs becoming a key concern in datacentre development and ongoing operation, the chips contained within servers need to be energy efficient as well as high performance. Putting a real-world slant on it, large firms, operating thousands of servers, would clearly be open to alternatives that promise lower consumption while not jeapordising performance.

ARM and Intel use different processor architectures to achieve the same aim: fast processing. The divergent architectures, however, run software in fundamentally different ways, meaning that applications designed for Intel CPUs need to be ported over to the ARM architecture. This added software-conversion expense is one reason why, until now, it has been very difficult for any processor-design company to break Intel's stranglehold on low-to-mid-range servers.

The ARM advantage

ARM's instruction set - the parameters that define an architecture - is simpler than the x86 adopted by Intel and AMD, and it is designed with energy efficiency very much to the fore, as evidenced by the company's unmitigated success in powering billions of mobile devices. But ARM is acutely aware that the needs of datacenter-type processors are different to those of a smartphone. This is why, in recent years and as a direct consequence of wanting to appeal to the cloud computing and enterprise markets, it has introduced a more feature-rich architecture called ARMv8.

This ARMv8 64-bit architecture, present in the Cortex-A57 and Cortex-A53 processors, is a key enabler of higher performance demanded by applications and workloads run in a typical datacentre, where the processor is working at near-peak capacity for far longer periods than on, say, a smartphone. While increasing performance with each new iteration of Cortex A-class chip, ARM continually focusses on delivering the best possible performance-per-watt for its partners; a metric that strikes at the very essence of modern datacentre design.

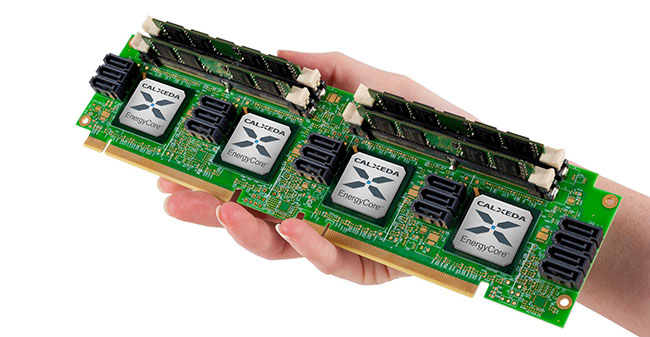

Analysts and researchers agree that ARM's v8 architecture has the potential to be used in servers and workstations, especially where the x86-baesd Intel Xeon or AMDs Opteron processors represent unnecessary overkill and use considerably more power than necessary. Well-known companies such as HP, Calxeda and, indeed, AMD have committed to launching server/workstation products based on ARM's architecture, and a number of other companies are actively investigating the potential of ARM chips.

Making steady gains

As an example, AMD, a previous stalwart of the competing x86 architecture that is championed by Intel, will be introducing a chip for web/enterprise applications called Seattle. Harnessing the ARM Cortex-A57 core in what is known as a system-on-chip (SoC) implementation, AMD believes the Seattle chip will be two to four times faster than the recently-announced Opteron processors featuring x86 Jaguar cores. Making comparisons between architectures is difficult at the best of times, but the common consensus is the ARM Cortex-A57 SoC will be at least as powerful but will consume significantly less power.

ARM is also banking on the fact that chips based on its designs tend to be cheaper than performance- and power-equivalent x86 processors from AMD and Intel. The simpler architecture and ARM's business model - one of royalties and licenses - enables competent partners to produce their own designs, which is not possible with x86-based chips from AMD and Intel.

ARM has identified that its high-end processor architecture represents an ideal fit for energy-efficient servers and workstations. Whether ARM designs will succeed in grabbing market share from Intel, whose chips power the majority of cloud computing and enterprise hardware, is dependent upon a number of other factors. Though ARM's partners in this space are increasing all the time, real traction will only be possible when a truly high-profile datacentre player, such as Google, Amazon or Facebook, adopts ARM's architecture, thus paving the way for smaller companies to follow the same path.

Through better-performing architectures - Cortex-A57 is a prime example - and close relationships with some of the key players in the enterprise market, ARM is slowly but surely making a compelling case for being considered as a viable alternative to the x86-based chips that have the lion's share of the market today. ARM's server-class processor designs are yet to ship in any significant volume, so the next 12 months or so, where we'll see actual ARM-based chips come to market, will define whether the British company has made an indelible mark on the lucrative server and workstation segments.