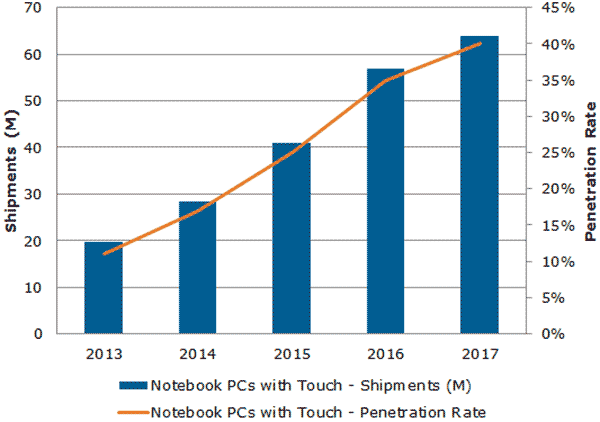

Recent market research shows that 11 per cent of laptops sold this year have been touch-ready notebook PCs. Although there has been an improvement in sales in the past year, touch notebooks still remain a tough sell said NPD DisplaySearch’s Richard Shim. It is also true that premium prices have been dominating most of the touch-notebook range, however “Customers think, ‘I shouldn't have to pay extra for touch, I get it free on my smartphone and tablet,’” says Shim. Also it also does not help that “there are really no apps that are forcing nor encouraging consumers to adopt touch.”

Graph from NPD DisplaySearch

Despite any compelling software NPD DisplaySearch’s recent forecast is showing a continuous climb, through to 2017, where 40 per cent of total laptop shipments are estimated to be of the touch-enabled variety. In the short term, high prices and lack of compelling apps will continue to be a barricade blocking wider acceptance. It has however been recently observed that “Brands are starting to realize there's no reason to charge a premium if people won't buy them,” Shim said, “so there has been some creep into these lower price bands.”

The idea that Windows 8 and the modern UI are encouraging take-up of touch screen laptops right now was rejected by NPD’s Shim, who noted that “Touch penetration on Windows 8 is still relatively modest,” and most users of Windows 8 still prefer to rely on mouse and keyboard. He thinks that consumers invest in tablet-like hybrids and buy touch notebooks not for Windows 8 but rather for these devices’ other modern flourishes, premium features and design-sense.

Notebook panel supply shortage

Since the rise in popularity of tablet PCs began in 2012, the notebook PC market has been faced with increasing pessimism. PC brands thought to counter tablets by emphasising lightweight and slim Ultrabook style designs, but these were/are ultimately still more expensive than most tablet PCs. Therefore to drive the volume of sales, PC brands are now changing their approach from pushing pricy ultra-slim products to lower-price notebooks/netbooks/Chromebooks.

The supply of PC panels has now tightened, as display manufacturers looked elsewhere to increase profits due to weak notebook expectations for the last quarter of 2013. Capacity was thus shifted towards other markets such as tablet PCs. Combined with PC builders’ attempts to limit orders of notebook panels in order to control inventories, we have the result of a lack of panels to meet the demand, and now rush orders are being placed to fill the gap.

Will cheaper Wintel 2-in-1s take off next year?

This short-term shortage of notebook panels is forcing brands to pay higher prices to secure priority for additional stock and could continue on to the first quarter of 2014 with Chinese New Year coming up in February with less Chinese workers willing to work overtime. This won’t help along the Wintel vision of the proliferation of keenly priced 2-in-1 designs in the early months of 2014.