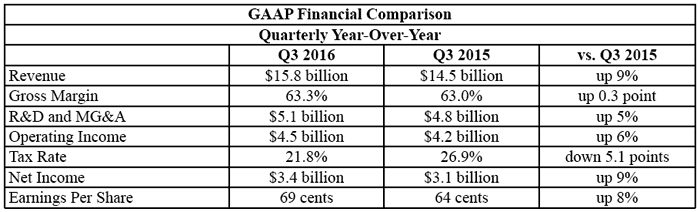

Intel has published its Q3 2016 financial reports. The highlights of the report, as headlined by Intel, include record quarterly revenue of $15.8 billion, which is a gain of 9 per cent on last year's figure. From the revenue Intel made profits of $4.5 billion. However, investors were not pleased with Intel's revenue guidance concerning Q4, which has resulted in Intel stock slipping as much as 5 per cent in value in afterhours trading.

"It was an outstanding quarter, and we set a number of new records across the business," said Intel CEO, Brian Krzanich, in the news release accompanying the financial statement. "In addition to strong financials, we delivered exciting new technologies while continuing to align our people and products to our strategy. We're executing well, and these results show Intel’s continuing transformation to a company that powers the cloud and billions of smart, connected devices."

However, part of the reason the investors are disappointed with Q4 projections is the impact of the 'continuing transformation' and necessary investments. Intel EVP Stacy Smith told CNBC the Q4 guidance is lower mainly due to Intel's next-gen manufacturing process start-up costs. Other negative influences on the Q4 outlook include; a forecast of $15.7 billion in revenue while analysts expected about $15.87 billion. Smith also expects the worldwide PC supply chain "to reduce their inventory," – this will impact the usual buoyant Q4.

Looking at the current set of results (Q3 2016) the traditional PC business still accounts for greater than half of Intel's total revenue and it went up by nearly $9 billion, that's 5 per cent year on year. Intel's data centre business revenue was up nearly 10 per cent to $4.45 billion. IoT revenue was up 20 per cent to $689 million. Meanwhile Intel's Non-Volatile Memory Solutions Group revenue was $649 million, down 1 percent year on year (but up 17 per cent sequentially). Intel Security Group revenue at $537 million was up by 6 per cent.

Overall the ascent of the Intel share price looks to have hit a speed bump as the growth areas that Intel is aiming at aren't quite providing the desired sparkling results at this time.