Samsung has reported its first annual earnings decline in three years. The firm posted a profit of 25tn Won for the full year, down from a record 36.8tn won in 2013 and marking the lowest yearly operating profit posted since 2011.

For the quarter, Samsung reported a 36 per cent dip in net profit to 5.3tn won ($4.8bn; £3.2bn) from 8.31tn won in the same period a year earlier, much in line with the 5.2tn won figure the company previously announced it was expecting. The news comes just a day after rival Apple reported the biggest profits in corporate history, breaking the record with $18bn in quarterly profit.

The disappointing results are largely blamed on plunging smartphone sales in the face of stiff competition from Apple and cheaper Chinese rivals, in addition to a stagnant product line. The South Korean electronics giant saw earnings from smartphones and other mobile gadgets plunge 64 per cent annually in the October-December period to 1.96tn won ($1.80bn), marking the mobile division's fifth consecutive quarter of decline, reports IT World. In contrast, Apple posted record-breaking 74.5 million iPhone sales in the three months to 27 December.

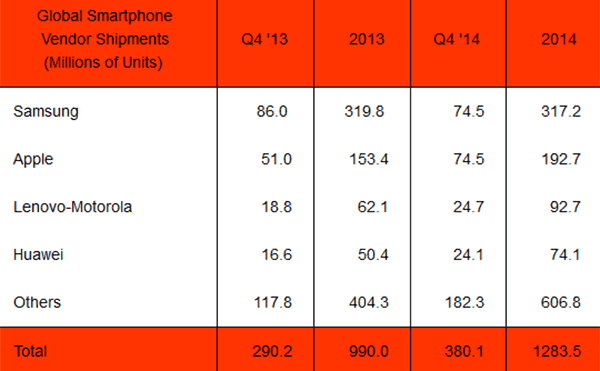

Global Smartphone Vendor Shipments and Marketshare in Q4 2014

chart from Strategy Analytics

"The mobile business will focus on increasing sales and improving business performance through new product line-ups, such as the Galaxy A series," Samsung said in a statement. The company expects the fall in demand for its smartphones and tablets to continue in the first quarter of 2015 due to seasonal factors. However, in an attempt to pick up shipments and average selling prices, Samsung has launched new mid-tier models like the Galaxy A3 and A5, which will become available in the UK as of 12 February.

A wee DRAM might help

On a positive note, a surge in the company's high-margin chip sales have slightly helped offset the downturn in its mobile business. Its semi-conductor division pulled in 2.7tn won in operating profit for the fourth quarter, a jump of almost 36 per cent compared to 1.99tn won in the same period a year earlier. The figure is also the highest Samsung has ever posted in more than four years.

Being the largest supplier of DRAM, the company is likely to focus more on its component business in 2015 as it saw healthy demand for memory chips as well as improved sales from its system chips business. Samsung announced a 15.6tn won investment in a chip manufacturing factory in Pyeongtaek, south of Seoul, last October and hopes to outpace overall industry shipments growth for DRAM and NAND chips this year.

"In 2015, DRAM growth is expected to continue into the first quarter, led by server DRAM for data centers and mobile DRAM for new smartphones," Samsung said in a statement.

Samsung hinted that it will be placing more focus on three specific directions going forward: a focus on unique products such as the Gear VR and the Note Edge, a more streamlined portfolio of products and efforts to expand its customer base and sales to emerging markets such as China and India.