Last week we saw Jon Peddie Research (JPR) publish a quarterly market watch report on GPUs. It showed that the CPU market was pretty healthy, up overall by 20 per cent from the previous quarter but more or less flat year-on-year. Now the research outfit has followed up with a report focussing upon the discrete GPU add-in board (AiB) market and how the major players are faring.

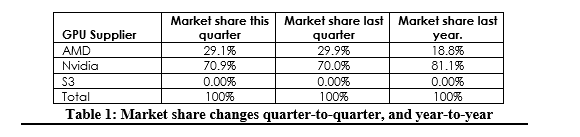

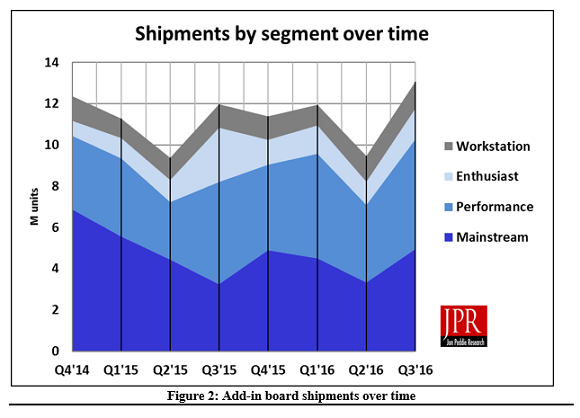

First of all the report indicates that market share movement from Q2 2016 to Q3 2016 is almost negligible. However as noted in the last report too, there has been a big seasonal upswing in GPU purchases. In Q3 2016 for AiB shipments that figure was up 38.2 per cent quarter to quarter (and gained 9.2 per cent year on year). Looking at the chart below shows that despite a big increase in discrete GPU sales the market shares between AMD and Nvidia remained remarkably stable over the quarter.

2016 has been very important for graphics card industry and enthusiasts, as it has seen both AMD and Nvidia push forward with long-awaited new architectures and a change in manufacturing processes. Considering the year on year figures it looks like AMD's Polaris has made the biggest splash with buyers this generation. AMD has impressively clawed back market share and is sitting at near 30 per cent now, compared with under 19 per cent a year ago.

Without doubt Nvidia still dominates, with a little over 70 per cent of the market. A positive for Nvidia we will likely see in a Q4 2016 report, if one is published, will be the market share impact of the recently released GeForce GTX 1050 and 1050 Ti cards. We describe these as mainstream cards and, living up to their name, they ship in much greater volumes than the upper echelon enthusiast models. In China, AMD has already reacted to the 1050 / 1050 Ti onslaught with its Radeon RX 470D.

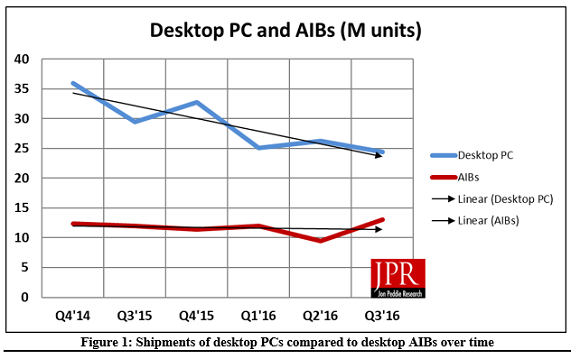

Contrasting the fate of the general desktop PC market to the AiB market JPR points out that while over the year AiB sales were up 9.2 per cent, while desktop PC sales were 17.1 per cent down. It's easy to see why systems makers are targeting this vibrant 'gaming PC' market segment.

All charts and diagrams via JPR.