Intel’s earning report was published after trading hours in the US last night. Despite disappointing sales in Q1 and now predicting Q2 revenue would decline by as much as eight per cent, the firm still thinks it will be able to steady the ship and achieve “low single digit” percentage growth during 2013.

The Wall Street Journal noted that in the latest financials Intel’s profits “dropped 25% on a 2.5% decline in revenue, reflecting declining sales of both desktop and laptop computers that use Intel microprocessors”. We aren’t so surprised, following last week’s market analysis by IDC which observed the steepest-ever decline in PC shipments since record began.

Helping to balance the books a little, even though Intel shipped seven percent fewer chips destined for PCs, it supplied six per cent more server chips than in the previous quarter.

Optimistic, positive and looking to the future?

The WSJ noted that Intel seemed to want to look forward rather than analyse the recent results. In what was Intel Chief Executive Paul Otellini’s final conference call before retirement, he said that “the company's position has never been stronger—largely because of manufacturing technology that creates transistors on its chip that consume less power and are less expensive than any other on the market”.

Or in a state of denial?

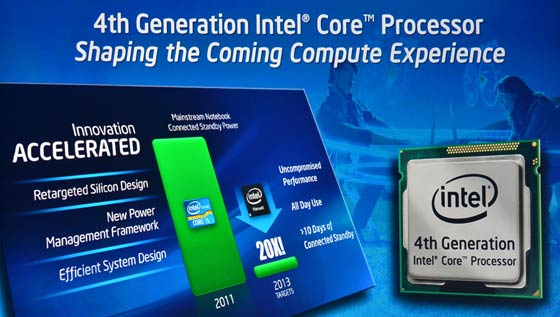

In the same conference call to analysts last night CFO Stacy Smith told investors that Intel’s fortunes would be revived this summer following the launch of the Haswell chip, a range of new ultra-thin laptops and an improving macroeconomic environment.

Have we heard similar forecasts from Chipzilla before? Bernstein Research analyst Stacy Rasgon seems to think so and is worried for investors; “That scares the hell out of me. They are holding to the same ultra-bullish (confident) forecast they gave before. They are presumably pretty bullish on the new products they are planning.”

So Intel has the ambitious target of turning around 2013’s growth following a poor H1. However the company has still implemented some savings and intends to cut capital spending from $13 billion to $12 billion this year.

I really do hope Intel’s optimism isn’t misplaced and the PC industry (not just Intel) can pull off a great turnaround with tempting new and innovative PCs coming out following Computex.