Strong ARM

While we're the first to celebrate the little Cambridge company that grew to dominate the low-power semiconductor world, we've often wondered whether there's a speculative bubble around its shares, fuelled by the realisation of its ubiquity in the booming mobile device market.

When we last suggested its stock was over-priced, it was trading at a pretty high P/E of around 80. With the announcement of its Q4 and FY 2010 results today, that P/E is now more like 100. While that's obviously very high, the figures are also pretty impressive, and make such an optimistic valuation seem a bit more reasonable.

For the quarter, ARM's revenues were up 34 percent year-on-year, profit was up 47 percent and EPS was up 62 percent. For the full year earnings were up 33 percent, but profits jumped a massive 73 percent, and that's in spite of ARM increasing its head-count by almost ten percent to 1,889 over the course of the year.

"ARM continues to sign licenses with influential market leaders in an increasingly digital world, and as the industry chooses ARM technology in a broadening range of electronic products, it further drives our long-term royalty opportunity," said CEO Warren East.

"The growth in licensing and royalty revenues, throughout 2010, has combined to deliver our highest ever annual revenues, profits and cash generation. 2011 will bring exciting opportunities and challenges as ARM enters competitive new markets and we are well positioned to succeed with leading technology, an innovative business model and a thriving ecosystem of partners."

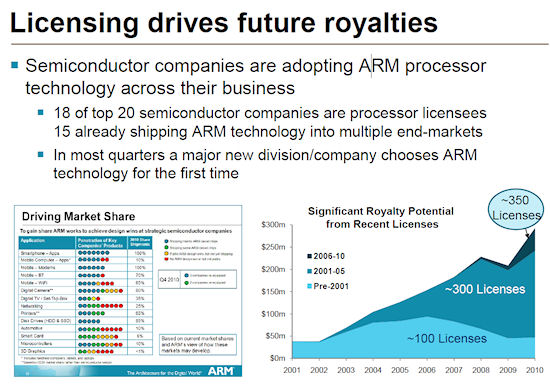

ARM doesn't sell products - it licenses designs and then claims royalties when those designs are used in chips and sold. The proportion of ARM's revenues has increasingly favoured royalties in recent years, but every new license sold will potentially result in a steady stream of royalties for year to come.

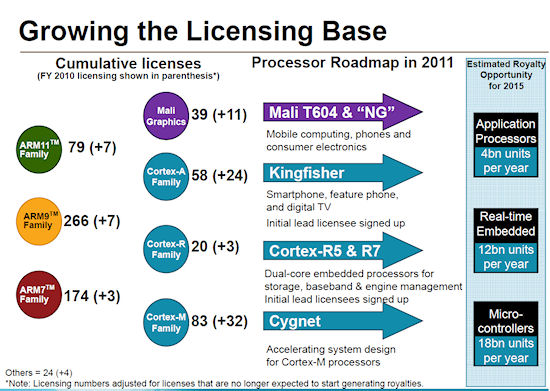

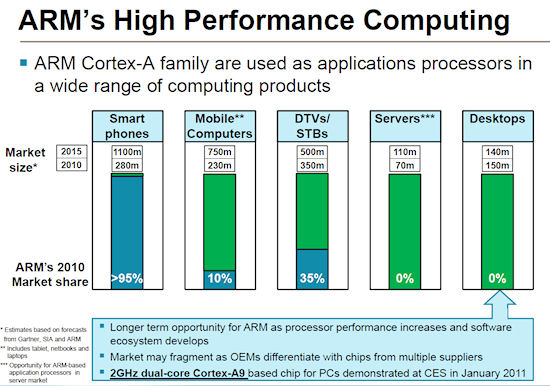

The table and slides below offer an idea of ARM's revenue growth potential. Of particular note for mobile devices is the growth in the number of Cortex A application processor licenses and Mali GPU licenses. The final slide is also interesting as a confirmation of ARM's intention to get involved in servers and desktops.

Q4 2010 and Cumulative Processor Licensing Analysis

|

|

Existing Customers |

New |

Quarter |

Cumulative Total* |

|

ARM7 |

|

1 |

1 |

174 |

|

ARM9 |

1 |

1 |

2 |

266 |

|

ARM11 |

2 |

1 |

3 |

79 |

|

Cortex-A |

10 |

1 |

11 |

58 |

|

Cortex-R |

1 |

|

1 |

20 |

|

Cortex-M |

4 |

3 |

7 |

83 |

|

Mali |

8 |

|

8 |

39 |

|

Other |

2 |

|

2 |

24 |

|

Total |

28 |

7 |

35 |

743 |

* Adjusted for licenses that are no longer expected to start generating royalties